Downtown office vacancies reached a new all-time high, but sales more than doubled in sign that market may have reached its bottom

Bradford Allen a national full-service real estate firm, today released its Q1/25 Downtown Chicago Office Market Report, showing direct vacancies decelerated to near equilibrium, while investment sales more than doubled year-over-year, in new signs of health for the market.

While direct vacancies reached a new all-time high of 23.4% in the first quarter, it was an increase of only 0.2 percentage points over fourth-quarter 2024, and absorption losses tallied only negative 173,000 square feet in the first quarter, a significant improvement over the negative 1.8 million square feet of office space vacated during first-quarter 2024 and negative 1 million square feet in fourth-quarter 2024.

Meanwhile, office investment sales totaled $156.7 million during the first quarter, more than double the $72.3 million that changed hands during the same period last year. Price corrections for these assets, along with office conversions that continue to remove outdated office inventory from the market, contribute to the notion that the market has reached a bottom.

“The latest data suggests growing confidence, and a potential turning point, for Chicago’s downtown office market,” said Neil Bouhan, senior managing director of research at Bradford Allen. “This surge in investment activity, price adjustments and conversions are fundamentally rebalancing supply and demand.”

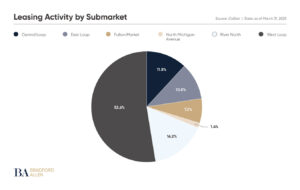

Leasing activity totaled 1.7 million square feet in the first quarter, similar to the same period last year. The West Loop accounted for just over half of new leasing, at 916,760 square feet, followed by River North (16.2% of activity) and the Central Loop (11.8% of activity). Though leasing volume was relatively low in Fulton Market, the submarket’s vacancy still sits well below the overall market at 15%.

Spec suites continued to outperform the market, accounting for 38.9% of square footage leased in the first quarter, compared with 26.6% during fourth-quarter 2024.

Expansions accounted for at least five of the 10 largest deals, several of which more than doubled the tenant’s footprint, notably Goldman Ismail’s 43,000-square-foot deal at 191 N. Wacker Drive, Stripe’s expansion at 350 N. Orleans St. to over 44,000 square feet and Blue Owl’s second expansion in recent years, which brought its footprint at 150 N. Riverside Plaza to 27,000 square feet.

Gas and oil company BP inked the quarter’s largest deal: a renewal for its entire 240,000-square-foot space at the CME Center at 30 S. Wacker Drive, which was secured in part by ownership’s extensive renovations to the property.

Additionally, high-profile retail deals such as Gap’s new 10,000-square-foot lease at 17 N. State St. and the new Harry Potter Shop Chicago at 676 N. Michigan Ave. on the Magnificent Mile will help draw more foot traffic to two of Chicago’s most iconic shopping corridors.

On the sales side, discounted pricing helped drive investment sales volume, with deals in the first quarter averaging $65 per square foot. 3Edgewood’s purchase of the former Groupon headquarters at 600 W. Chicago Ave. was the largest office sale in Chicago since 2022. The 1.6 million-square-foot property sold for an 83% discount compared to its prior sale price.

Developers pitched two new potential office conversions during the first quarter: one in the West Loop and the other for a portion of the famed Pittsfield Building at 55 E. Washington St. Together, these projects would deliver approximately 300 new residential units downtown and remove 130,200 square feet of office space.

Notable office foreclosures in the first quarter included 10 S. LaSalle St. in the Central Loop and 350 N. Orleans St. in River North. Goldman Sachs, the lender on 350 N. Orleans, seized the asset from Blackstone and plans to list the property in a foreclosure auction, helping correct market prices further.

Meanwhile, fresh debt remained available for well-performing office assets, including Salesforce Tower’s $610 million refinancing and Willis Tower’s $1.3 billion in new debt, both via commercial mortgage-backed securities (CMBS). The former deal, set to be finalized in the coming weeks, is one of the largest refinancing packages in years in downtown Chicago. In both cases, the properties’ strong leasing programs and low vacancy rates helped secure lender confidence, highlighting demand for resilient trophy assets.

About Bradford Allen:

Bradford Allen (BA) is a commercial real estate and investment services firm based in the heart of downtown Chicago. Founded in 2003 by principals Jeff Bernstein and Larry Elbaum as an office brokerage, the firm has grown into a vertically integrated commercial real estate company offering a full array of services and expertise across multiple U.S. markets to entrepreneurial, corporate and not-for-profit clients, including strategy, marketing and transaction execution for occupiers, investors and owners. For more information, visit bradfordallen.com.

The West Loop accounted for a little more than half the office leasing activity in first-quarter 2025 in downtown Chicago, followed by River North and the Central Loop.