Bradford Allen, a national full-service real estate firm, today released its “Q3/25 Downtown Chicago Office Market Report.” While direct vacancies remained flat from the previous quarter, absorption rebounded considerably, suggesting the CBD office market continues to regain its footing. Led by the West Loop submarket, approximately 1.8 million square feet of leases were signed over the past three months.

The Chicago CBD recorded a 24.4% direct vacancy rate, slightly lower but in line with last quarter’s record high. Meanwhile, the negative 173,000 square feet of absorption was a drastic improvement from the second quarter’s negative 1.7 million square feet.

Office investment sales totaled approximately $101 million during this period, with year-to-date sales volume reaching approximately $376 million through the third quarter. While lenders and equity remained selective, financing rewarding owners able to improve systems, add amenities and deliver ready-to-occupy space.

“The latest data suggests signs of stabilization across Chicago’s downtown office landscape,” said Neil Bouhan, senior managing director of research at Bradford Allen. “With vacancies holding steady and leasing volume remaining strong, tenants are signaling greater confidence, hinting that recovery continues.”

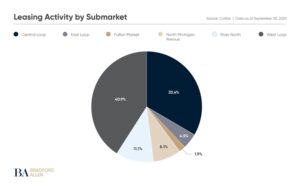

Downtown leasing activity totaled approximately 1.8 million square feet in the third quarter, down from the approximately 2 million square feet of leases recorded the prior quarter. Buoyed by its good transit access and amenity-forward towers, the West Loop accounted for approximately 41% of new leasing. Across the rest of the CBD, the Central Loop accounted for 33% of activity, followed by River North at 11%, North Michigan Avenue at 8%, the East Loop with 4% and Fulton Market at 2%.

Global management consulting firm Bain & Company executed the largest new lease of the quarter, taking 173,186 square feet at 131 S. Dearborn St. in the Central Loop. The two next-largest leases were in the West Loop, where Wolverine Trading signed an 83,000-square-foot sublease at the Old Post Office and Interactive Brokers inked a deal for 67,015 square feet at 10 S. Riverside Plaza.

Average direct gross asking rents held in the low $40s per square foot, with the West Loop commanding the highest rates, followed by River North. Accounting for 40% of square footage leased year-to-date, move-in ready suites remained highly sought-after as tenants prioritized speed to occupancy and capital efficiency.

Renewal activity continued to make up a key segment of the market as tenants showed a willingness to recommit to well-maintained buildings. Law firm ArentFox Schiff extended 75,000 square feet at Willis Tower, Convene renewed 57,326 square feet at 311 W. Monroe St. and the American College of Healthcare Executives renewed 36,189 square feet at 300 S. Riverside Plaza.

Capital markets activity tended to favor distressed, discounted or value-add projects, though activity fluctuated across submarkets. In the West Loop, Two North Riverside Plaza traded for $27.75 million ($48 per square foot), while 125 S. Wacker Drive was placed under contract around $50 million ($88 per square foot). Conversely, closings on smaller assets in River North clustered around the low- to mid-$100s per square foot.

A full copy of the report can be downloaded here: https://www.bradfordallen.com/q3-25-downtown-market-report/.

About Bradford Allen:

Bradford Allen (BA) is a commercial real estate firm based in the heart of downtown Chicago. Founded in 2003 by Jeff Bernstein and Larry Elbaum as an office brokerage, the firm has grown into a vertically integrated commercial real estate company, offering a full array of services and expertise across multiple U.S. markets to entrepreneurial, corporate and not-for-profit clients, including strategy, marketing and transaction execution for occupiers, investors and owners. For more information, visit bradfordallen.com.

Downtown Chicago saw approximately 1.8 million square feet of office space leased in the third quarter, according to Bradford Allen’s Q3/25 Downtown Chicago Office Market Report, with the West Loop (41%), Central Loop (33%) and River North (11%) driving the most activity.