Bradford Allen, a national full-service real estate firm, today released its Year-End 2024 Office Market Report: Suburban Chicago and Q4/24 Office Market Report: Downtown Chicago research reports. Among other findings, the firm reported the suburban Chicago office vacancy rate was 24.6% at the end of 2024, slightly up from 24% during the first half of the year, but rents slightly rose to $27.53 per square foot. Meanwhile, the downtown office vacancy rate rose to a new record high of 23.2% in the fourth quarter from 22% at midyear, and gross asking rents were unchanged from the third quarter at $42.85 per square foot.

Despite the high vacancy rates, both the downtown and suburban office markets showed signs of positive momentum. Leasing improved slightly downtown compared to the previous quarter, with 2.4 million square feet leased in the fourth quarter and 8.2 million square feet for all of 2024, just below 2023’s level of 8.3 million square feet. Built-out vacant space remained competitive and commanded 38% of overall leasing activity in the suburbs. Likewise, sublet vacancy in the suburbs dropped to a mere 0.7% at the end of the year. Older office properties continue to struggle, but discounted valuations are driving investment and conversion projects are slowly removing inventory from the market.

“As the data shows, the Chicago office market remains in transition, but there are bright spots pointing to recovery and adaptation,” said Neil Bouhan, senior managing director, research and communications, at Bradford Allen. “Suburban leasing activity is holding steady, driven by built-out spaces and spec suites, while Fulton Market downtown continues to outperform with positive absorption and strong tenant interest. Investment opportunities, particularly in properties with upgrades or conversion potential, signal optimism for long-term market correction.”

For example, all fourth-quarter investment sales downtown came at notable discounts, with properties averaging a 73% markdown from their previous sale price. About $405 million worth of office properties traded hands in 2024 in downtown Chicago, up from $140 million in 2023 but still far below the $1.4 billion in sales reported in 2019.

Multiple office-to-residential projects entered the pipeline downtown during the fourth quarter: the Clark Adams Building (105 W. Adams St.) and 19 S. LaSalle St. in the central Loop, and 811 W. Evergreen and 1415 N. Dayton on the Near North Side. Together, these projects will aid the market by removing approximately 600,000 square feet of office space.

Downtown Chicago

Engineering design firm Sargent & Lundy signed the largest downtown office lease in over three years during the fourth quarter: a 384,000-square-foot deal at 77 W. Wacker Drive. Other highlights include:

- Spec suites and full build-outs continued to outperform the market, accounting for an increasing share of leasing activity — 28.6% in 2024, up from 9% in 2019.

- Fulton Market continued to outperform by maintaining the lowest vacancy rate (16.4%) among all Chicago submarkets and achieving positive net absorption of approximately 58,500 square feet.

- With $5.4 billion in office loans set to expire within the next two years, the market may still have more distress to digest.

Suburban Chicago

Suburban office sales totaled $368 million, exceeding 2023’s $270 million but trailing 2019’s $466 million. This includes the $35 million purchase of Innovation Park Lake County in Libertyville, Ill., by a venture of R2 and JDI Realty. In line with market trends, the new owners plan to invest in move-in-ready spec suites.

Other highlights include:

- Leasing was stable, totaling 5.7 million square feet for the year, up from 5.2 million square feet in 2023. Built-out and spec suites drove 38% of activity.

- The northern suburbs saw positive absorption of 49,400 square feet, with notable deals like Medline’s 214,000-square-foot lease in Northbrook.

- Most of the suburban market’s distress lies in older, poorly located properties, which account for only 2.7% of the suburbs’ overall office inventory.

- $2.55 billion of suburban office debt is maturing before 2027 and will continue to affect investment decisions.

See the reports here:

Q4/24 Office Market Report: Downtown Chicago

Year-End 2024 Office Market Report: Suburban Chicago

About Bradford Allen:

Bradford Allen (BA) is a commercial real estate firm based in the heart of downtown Chicago. Founded in 2003 by Jeff Bernstein and Larry Elbaum as an office brokerage, the firm has grown into a vertically integrated commercial real estate company, offering a full array of services and expertise across multiple U.S. markets to entrepreneurial, corporate and not-for-profit clients, including strategy, marketing and transaction execution for occupiers, investors and owners. For more information, visit bradfordallen.com.

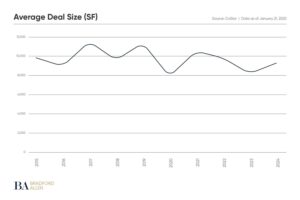

The average office lease size has been relatively steady in downtown Chicago on an annual basis, ranging from 8,000 to 10,000 square feet in recent years.